Managing wealth and securing your family’s future can be tricky. Starting a family trust in Canada is one way to protect assets, save on taxes, and ensure your money stays within the family. But what exactly is a family trust, and how does it work?

Let’s find out together!

What Is a Family Trust?

A family trust is a way to protect and manage assets for your family. It helps with tax savings, keeps wealth in the family, and makes sure your assets go where you want.

It works like this:

One person (the settlor) gives assets to another person (the trustee). The trustee then manages these assets for the people who benefit from the trust (the beneficiaries). The assets can be anything, money, property, investments, or even a business.

Once something goes into a family trust, it no longer belongs to the person who gave it. It belongs to the trust, and the trustee must follow the rules set in the trust document.

How a Family Trust Works

A family trust usually has three key players:

- Settlor

- Trustee

- Beneficiaries

Who Is the Settlor?

The settlor is the person who creates the trust. After setting it up, they step back and don’t usually have any further involvement. They also typically don’t benefit from the trust.

- In Quebec: The settlor must transfer their assets into a separate entity called a trust patrimony.

- In the rest of Canada: A trust is formed when the settlor gives control of assets to the trustee. In common law, a trust is seen as a relationship rather than a separate entity.

It’s important to understand the tax rules when transferring assets into a family trust. Speaking with an expert can help avoid tax surprises.

Who Is the Trustee?

The trustee manages the trust’s assets and decides how and when they are distributed to beneficiaries. Trustees have a legal duty to act in the best interests of the beneficiaries.

A trustee’s responsibilities include:

- Acting with honesty and care

- Avoiding conflicts of interest

- Keeping records and being accountable

- In Quebec: Trustees are only administrators and don’t own the trust assets. If the trustee is also a beneficiary or a settlor, there must be another independent trustee.

- In the rest of Canada: The settlor can also be a trustee, but this isn’t recommended for family trusts due to tax rules.

Who Are the Beneficiaries?

The beneficiaries are the people who receive income or assets from the trust. The trust agreement determines how much they receive and when.

In a family trust in Canada, beneficiaries are usually family members, but a business or another trust can also be included. This structure allows families to protect wealth, plan for the future, and take advantage of tax benefits.

Understanding how this works can help you decide if it’s the right choice for your family’s financial future.

Types of Trusts in Canada

When it comes to setting up a family trust in Canada, there are two main types: testamentary trusts and inter-vivos trusts.

Each serves a different purpose, depending on when and why the trust is created.

Testamentary Trusts

A testamentary trust is created after someone passes away. It is usually set up according to the instructions in a person’s will or by court order. The main goal is to manage and distribute the deceased person’s assets to beneficiaries over time instead of giving everything out at once.

This type of trust is generally only funded by assets that come from the deceased’s estate. However, if assets are added to the trust from someone who is still alive, or if the trust takes on debt in certain ways, it may no longer qualify as a testamentary trust and could be treated as an inter-vivos trust for tax purposes.

Inter-Vivos Trusts (Living Trusts)

An inter-vivos trust is set up while a person is still alive. This is different from a testamentary trust, which is only created after death.

There are two main types of inter-vivos trusts:

- Discretionary Trust

- The trustee has full control over how and when assets are distributed.

- Most family trusts in Canada are discretionary.

- This setup allows wealth to be managed flexibly, ensuring that assets go to beneficiaries as needed rather than being automatically distributed.

- Non-Discretionary Trust

- The trustee must follow specific rules for distributing assets as outlined in the trust agreement.

- The beneficiaries receive their share according to a set schedule or conditions.

Some trusts can be a mix of both, discretionary for income and non-discretionary for capital depending on your requirement. For example, the trustee might decide how much income to distribute each year but must follow a fixed rule when giving out capital assets.

Family Trust Tax Benefits in Canada

A family trust in Canada can offer some tax advantages, but it also comes with rules that you need to follow. A trust itself is considered a taxpayer, even though it’s not a legal entity. Any income left inside the trust is taxed at the highest personal rate, so it’s often smarter to distribute income to beneficiaries in lower tax brackets.

However, the attribution rules prevent people from using trusts to avoid taxes unfairly. These rules make sure that income from a trust isn’t simply shifted to a lower-income family member without real ownership changes.

How a Family Trust Can Reduce Taxes

A family trust can be useful in several ways when it comes to taxes:

- Reducing taxes after a beneficiary’s death

- If a shareholder doesn’t need future capital gains from their company, they can use an estate freeze strategy. This keeps the capital gain inside the trust instead of triggering taxes when they pass away. A professional accountant can help decide if this is right for you.

- Income splitting with family members

- Canada has a progressive tax system—the more you earn, the higher your tax rate.

- A family trust can distribute income to beneficiaries in lower tax brackets to reduce the total family tax bill.

- Deferring tax with a corporate beneficiary

- If a corporation is named as a beneficiary, business profits can flow through the family trust to the corporate beneficiary. This can help defer taxes until the funds are withdrawn.

Other Benefits of a Family Trust in Canada

It isn’t just about taxes. It can also help with:

- Avoiding probate – Assets in a living trust are not part of your estate when you pass away. This can help avoid probate fees and delays.

- Keeping your financial affairs private – Unlike a will, which becomes public, a trust keeps your assets private.

- Capital gains exemption – If a trust owns shares in a qualified small business corporation, it may qualify for the lifetime capital gains exemption (LCGE), reducing tax on a sale.

- Protecting assets from creditors – If set up properly, a trust can shield assets from creditors since they are no longer in your name.

- Ensuring fair wealth distribution – This is especially useful for blended families to prevent inheritance conflicts.

- Providing lifetime income for a spouse – A trust can ensure your spouse is supported while preserving assets for the next generation.

- Controlling how and when children receive assets – A trust allows you to set rules on when and how your children get their inheritance.

Disadvantages of a Family Trust in Canada

While a family trust has benefits, there are also some downsides to consider.

- The 21-Year Rule

- After 21 years, a trust is treated as if it sold all its assets at fair market value, triggering potential capital gains tax.

- There are ways to reduce this tax impact, such as donating appreciated securities from the trust.

- Tax on Split Income (TOSI)

- Cost of Setting Up and Maintaining a Trust

- A family trust requires legal fees to set up and annual tax filings, which add to your costs.

- If you are a U.S. citizen or resident, cross-border tax rules can complicate things. You’ll need a tax expert familiar with both Canadian and U.S. laws.

If you need help from tax accountant take a look at this blog on “How to Find the Best Tax Accountant in Toronto: A Guide for Business Owners”

How to Set Up a Family Trust in Canada

Thinking about setting up a family trust in Canada? It can be a smart way to protect assets, manage wealth, and even reduce taxes.

Before you start, ask yourself these key questions:

- What do you want to achieve? Are you looking to protect wealth, split income, or plan your estate?

- Who will be involved? You’ll need to name a settlor, trustee(s), and beneficiaries.

- What assets will go into the trust? This could include money, property, investments, or business shares.

- Who can help you? A tax expert, lawyer, or financial advisor can guide you through the process.

Once you have your answers, follow these key steps:

Steps to Create a Family Trust in Canada

1. Draft the Trust Agreement

The trust agreement (or trust deed) is the legal document that defines the trust. It lays out its purpose, names the trustees and beneficiaries, and includes rules for managing the assets. A notary or tax lawyer should handle this step to ensure it meets legal and tax requirements.

2. Make an Initial Gift

A family trust is created when the settlor transfers an asset into it. To avoid attribution rules, this initial asset is often something small, like a silver coin or a gold bar. Once this step is done, the settlor usually has no further role in the trust.

3. Open a Bank Account for the Trust

Your family trust will need its own bank account to manage funds. A financial institution can help set this up.

4. Transfer Assets into the Trust

Your tax advisor can help you decide which assets to transfer and how to do it properly. Common assets placed in a family trust include:

- Real estate

- Cash and bank accounts

- Investments (stocks, bonds, mutual funds)

- Company shares

- Collectibles and heirlooms

5. Register the Trust (If Required)

Some family trusts in Canada need to be registered, depending on your province. A lawyer or tax specialist can tell you if this applies to your trust.

How Are Family Trusts Taxed in Canada?

A family trust isn’t a legal entity, but it is treated as a separate taxpayer. It must file a T3 tax return and report its own income. Here’s how taxation works:

1. High Tax Rates on Trust Income

- Trusts are taxed at the highest personal marginal tax rate on any income they keep.

2. Attribution Rules

- Canada has attribution rules to prevent tax avoidance. If trust income goes to a spouse or minor child, it may still be taxed in the hands of the original contributor.

- There are exceptions, like alter ego trusts and joint partner trusts.

3. Tax Benefits of a Family Trust in Canada

A family trust can still offer tax benefits, including:

- Income splitting – Shifting income to lower-tax family members.

- Capital gains tax deferral – Capital gains aren’t taxed until beneficiaries sell assets.

- Dividend tax credit – If a trust holds shares in a Canadian corporation, dividends can be taxed at a lower rate.

4. Lifetime Capital Gains Exemption (LCGE)

- If a family trust owns shares in a qualified small business corporation (QSBC) or farm/fishing property, it can pass capital gains to beneficiaries.

- This allows multiple family members to claim the LCGE, reducing the total tax paid on a business sale.

Using a Family Trust for a Prescribed Rate Loan

Another tax planning strategy is a prescribed rate loan. Here’s how it works:

- A family member in a high tax bracket loans money to the trust at the prescribed interest rate (which is often low).

- The trust invests the money and earns income.

- The trust pays the lender interest at the prescribed rate, but any extra investment income is taxed in the hands of lower-income beneficiaries.

This strategy allows high-income individuals to shift investment earnings to family members in lower tax brackets, reducing the overall tax bill.

Is a Family Trust Right for You?

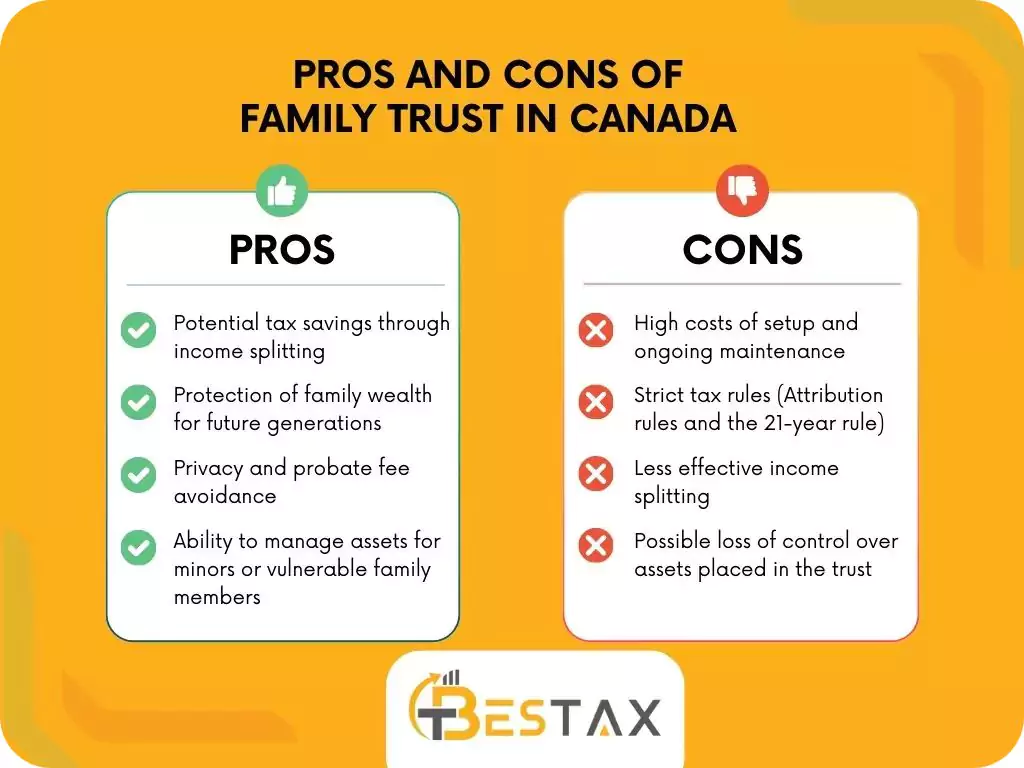

A family trust in Canada can be a powerful tool for wealth management, estate planning, and tax reduction. Here are some pros and cons of having a family trust in Canada.

If you’re considering setting up a family trust in Canada, consulting with a tax professional or lawyer is essential.

Set Up Your Family Trust with Bestax

A family trust is a smart way to protect wealth, reduce taxes, and secure your family’s future. But setting it up right requires expert guidance.

At Bestax, we handle everything—from trust setup and tax planning to CRA compliance and estate structuring. Our experienced accountants and tax advisors ensure your trust is legally sound and maximizes tax benefits.

Let’s make your family’s financial future secure. Book a free consultation today!

FAQs on Family Trusts in Canada

What are the benefits of a family trust in Canada?

A family trust helps protect wealth, reduce taxes, control asset distribution, and avoid probate. It also allows income splitting and can defer capital gains taxes.

What are the disadvantages of a family trust?

It can be costly to set up and maintain, requires strict compliance with tax rules, and is subject to the 21-year rule, which may trigger taxes on capital gains.

How much does it cost to set up a family trust in Canada?

Costs vary but typically range from $3,000 to $10,000 for legal and accounting fees, plus ongoing tax filing and management costs.

What are the risks of a family trust?

Potential risks include tax complications, loss of direct control over assets, legal fees, and possible changes in tax laws affecting benefits.

What type of trust is a family trust?

A family trust is usually a discretionary inter-vivos trust, meaning trustees decide how and when assets are distributed to beneficiaries.

How does a family trust work in Canada?

A settlor transfers assets to a trustee, who manages them for beneficiaries. The trust can hold money, real estate, business shares, or investments and distribute income to lower-tax family members.

Can I transfer my house to a family trust?

Yes, but there may be capital gains tax, land transfer tax, and legal fees. It’s best to consult a tax expert before doing so.

What are the tax benefits of a family trust in Canada?

A family trust allows income splitting, tax deferral, access to the lifetime capital gains exemption (LCGE), and dividend tax credits if structured properly.

Is it better to have a revocable or irrevocable trust?

In Canada, irrevocable trusts are more common for tax planning, as revocable trusts may not provide the same tax benefits due to attribution rules.

Disclaimer: The information provided in this blog is for general informational purposes only. For professional assistance and advice, please contact experts.