Starting a business in Ontario or anywhere in Canada can feel like an exciting yet challenging journey, but you’re not alone!

In August 2024 alone, 14,104 new businesses were registered in Canada, a significant 32.3% increase from July 2024, as reported by Cleanlist. This increase reflects the growing hustle trend that is going on around the world these days.

Statistics from Innovation, Science and Economic Development Canada show that about 40% of small businesses with one to four employees don’t make it past their fifth year. Overcoming those odds requires determination, preparation, and the right support. That is where we come in!

So keep reading for a step-by-step guide on everything from business name registration to understanding laws regarding business and setting up your legal entity. Whether you’re exploring a sole proprietorship, planning to incorporate your business, or need professional help, we’ve got you covered.

First let’s take a quick look at a table summarizing key facts about starting a business in Ontario.

| Aspect | Details |

| Types of Companies | Sole Proprietorship, Partnership (General, Limited, Limited Liability), Corporations & Cooperatives |

| Minimum Share Capital | None for private corporations (LTD equivalent) |

| Minimum Shareholders for a Limited Company | 1 |

| Time Frame for Incorporation | 1 day (approx.) |

| Corporate Tax Rate | 38% (with possible reductions) |

| Dividend Tax Rate | 10% (can reach 40% in certain situations) |

| VAT (GST) Rate | 5% |

| Number of Double Taxation Treaties (Approx) | 94 |

| Registered Address Provided | Yes |

| Local Director Required | Not required in Ontario |

| Annual Meeting Required | Yes |

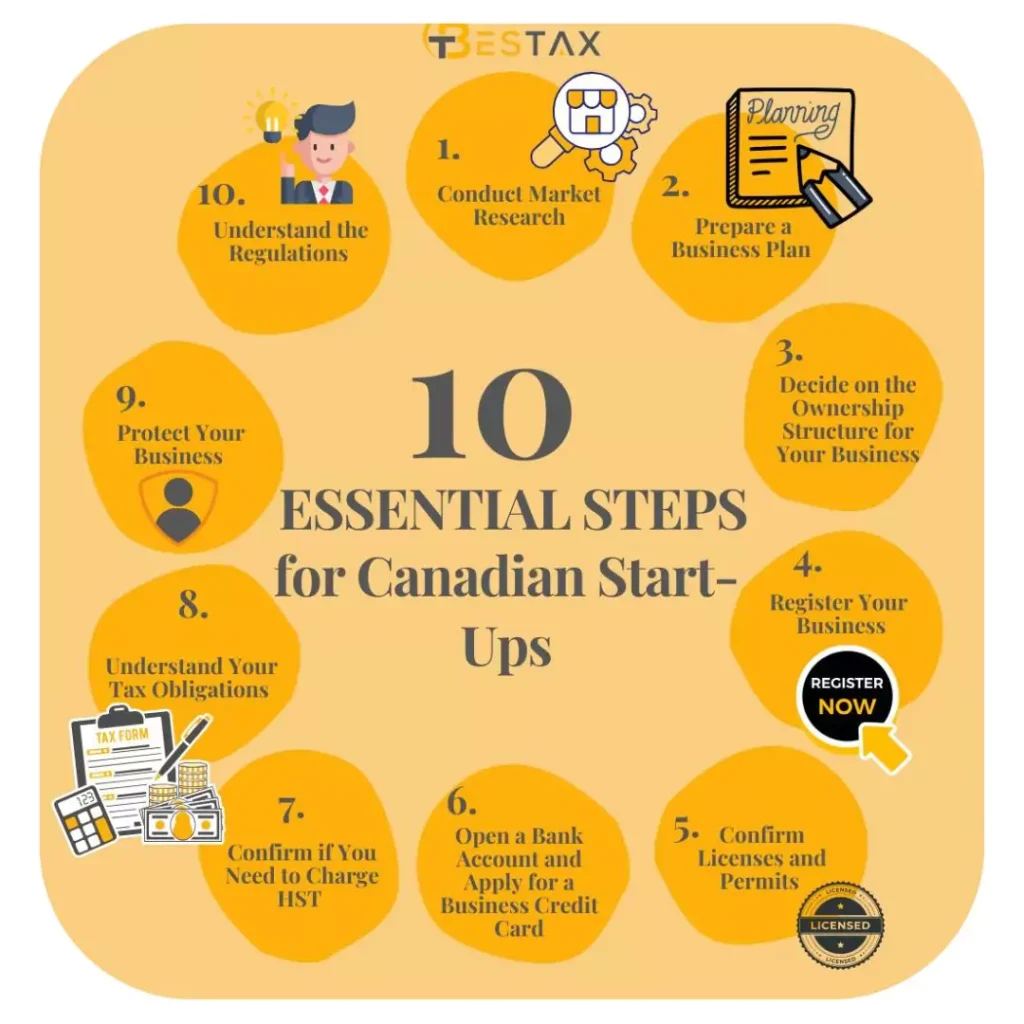

Start a Business in Ontario: 10 Essential Steps for Canadian Start-Ups

Starting a business in Ontario is an exciting adventure, but knowing where to begin can feel overwhelming. This guide outlines 10 essential steps to help you confidently launch your business.

Please note: This guide is for informational purposes only and is not a substitute for legal or financial advice.

Step 1: Conduct Market Research

Market research is your first step to understanding your industry, customers, competitors, and overall business environment. You need to know your market before you start your business.

Here’s what to focus on:

- Customer Demographics: Use Statistics Canada to understand your target market.

- Competitors: Research where customers currently buy similar products or services.

- Location: Connect with local Business Improvement Associations (BIAs) for area-specific insights.

- Finances: Estimate startup costs, including business registration, marketing, advertising, licensing, insurance, rent, utilities, product development, and a website.

- Business Name & Online Presence:

- Choose a memorable business name and check if the domain name (website address) is available.

- In Ontario, you can incorporate your business with an English and/or French name (each requiring a separate NUANS report) or add a version in another language.

- All incorporated businesses must end with Limited (Ltd.), Limitée (Ltée.), Incorporated (Inc.), or Corporation (Corp.).

- Alternatively, you can incorporate with a number name, then register and trademark a trade name for brand protection.

Ready to move to the next step? Keep reading to continue your journey to start a business in Ontario!

Step 2: Prepare a Business Plan

A solid business plan is the foundation of starting a business in Ontario or anywhere in the world. It explains your business idea, outlines your short and long-term business goals, and identifies the resources needed to start and grow your business.

Basic Elements of a Business Plan

- Executive Summary: A brief overview of your business plan and key takeaways.

- Business Overview: Describe your products and services, your target market, and industry trends.

- Sales and Marketing Plan: Outline your target customers, pricing strategy, and marketing approach.

- Operations Plan: Cover details like location, equipment, production process, and customer interactions.

- Human Resources Plan: Define the number of employees, hiring plans, and policies for recruitment and retention.

- Action Plan: Create a timeline for achieving key milestones.

- Financial Plan: Include projections for revenue, expenses, cash flow, and a budget for at least two years, with a focus on the first 12 months.

Now that you have a solid plan let us look into the type of ownership structure you can opt for.

Step 3: Decide on the Ownership Structure for Your Business

Choosing the right ownership structure is a key step when starting a business. Each structure has unique legal requirements, tax implications, and business responsibilities. Let’s look at their pros and cons:

1. Sole Proprietorship

A sole proprietorship is the simplest and most common way to start a business in Ontario.

| Pros | Cons |

| Full control over your company | Responsible for all debts and losses |

| Easy and affordable to set up | Creditors can claim personal assets |

| Ability to deduct losses and expenses from personal income | Business name is not protected |

| You earn all the profits | Income taxed at your personal tax rate |

2. Partnerships

A partnership involves two or more people sharing ownership of the business.

| Pros | Cons |

| Easy and cost-effective to set up | Shared responsibility for debts and losses |

| Shared costs and diverse skills | Potential conflicts in decision-making |

| Expenses and losses can be included in partners’ tax returns | Finding the right partner can be challenging |

3. Corporations

A corporation is a separate legal entity from its owners. You can incorporate federally or provincially.

| Pros | Cons |

| Limited liability for owners | Higher setup and maintenance costs |

| Easier transfer of ownership | Complex tax rules |

| Access to more capital and grants | Mandatory annual filings and corporate records |

| Business name protection (if federally registered) |

4. Co-operatives

A co-operative is a corporation organized and controlled by its members and can operate for-profit or not-for-profit.

| Pros | Cons |

| Limited liability for members | Slower decision-making process |

| Democratic decision-making (one member, one vote) | Success depends on active participation from members |

Step 4: Register Your Business

If your business has employees, facilities, or offices in Ontario, you must register using the Ontario Business Registry.

Requirements for Online Registration:

- A working email address

- A valid debit or credit card

- Payment based on the type of business structure:

- Sole Proprietorship: $60

- General Partnership: $60

- Limited Liability Partnership: $60

- Limited Partnership: $210

- Business Corporation: $300

If registering a Business Corporation, you’ll also need a Nuans Name Search Report (Ontario-biased).

After registration, you’ll receive a 9-digit Ontario Business Identification Number (BIN) from ServiceOntario. This is different from a Business Number (BN) issued by the Canada Revenue Agency (CRA).

You’ll need your BIN to:

- Incorporate your business

- Create an import/export account

- Register with the CRA

Registration Requirements for Sole Proprietorship & Partnerships

- Register your business name with the Ontario Business Registry.

- Obtain a federal business number (BN) and necessary tax accounts.

- Apply for any permits or licenses your business may need.

Registration Requirements for Corporations

- Incorporate provincially or federally via the Ontario Business Registry.

- Obtain a federal business number (BN) and corporate tax account from the CRA.

- Apply for any permits and licenses.

- Extra-provincial registration may be needed if operating outside Ontario.

- Conduct an Ontario-biased Nuans Name Search to reserve your business name.

Registration Requirements for Co-operatives

- Incorporate under the Canada Cooperatives Act (Coop Act).

- Submit Articles of Incorporation (Form 3001) and Initial Registered Office Address and First Board of Directors (Form 3002).

- Conduct a Nuans Name Search for business name reservation.

- Pay the required filing fees.

This guide covers everything you need to know about choosing a business structure and registering a business in Ontario.

Ready to move on to the next step?

Step 5: Confirm Licenses and Permits

When starting a business in Ontario, ensuring you have the right licenses and permits is crucial for meeting federal, provincial, and municipal regulations.

Proper licensing is not just about compliance, it protects your business and builds trust with your customers.

Take this step seriously to avoid unexpected delays or fines.

Step 6: Open a Bank Account and Apply for a Business Credit Card

Managing your business finances effectively starts with separating your business and personal accounts.

Why open a business bank account?

- Clear tracking of expenses and income

- Builds a credit history for your business

- Provides financial transparency for decision-making

Next Steps:

- Research different business bank accounts offered by Canadian banks.

- Compare fees, benefits, and features to find one that suits your business needs.

- Consider applying for a business credit card to manage cash flow and build credit.

A dedicated business bank account is a key step in ensuring your business finances stay organized from day one.

Eager to know the next step in starting a business in Ontario? Let’s keep the momentum going!

Step 7: Confirm if You Need to Charge HST

When starting a company in Canada, it’s essential to determine whether you need to register for a GST/HST account and collect Harmonized Sales Tax (HST) on your sales.

Do You Need to Charge HST?

- If your business earns $30,000 or more in gross revenue over four consecutive calendar quarters (a total of 12 months), you must register for a GST/HST account with the Canada Revenue Agency (CRA).

- Businesses below this threshold may voluntarily register to claim input tax credits on purchases.

Key Facts About HST in Ontario:

- Effective July 1, 2010, Ontario adopted the Harmonized Sales Tax (HST), replacing the 5% GST and 8% RST (Retail Sales Tax).

- The current HST rate in Ontario is 13% (5% federal + 8% provincial).

- Certain items qualify for a point-of-sale rebate on the 8% provincial portion of HST.

How to Register for an HST Account:

- Contact the Canada Revenue Agency (CRA).

- Provide necessary business details (e.g., business number, estimated revenue).

- Learn about taxable goods and services to ensure proper compliance.

Proper HST registration ensures your business stays compliant and avoids unnecessary penalties.

Step 8: Understand Your Tax Obligations

When starting a business in Ontario, it’s essential to understand your tax responsibilities to remain compliant and avoid unnecessary penalties.

Self-Employed, Sole Proprietorship, or Partnership:

- You must report your business income on your personal tax return annually.

- Contributions to the Canada Pension Plan (CPP) are mandatory if you’re self-employed.

Corporations:

- Must file a corporate income tax return separately from personal taxes.

- Tax rates and obligations vary based on income and business activities.

For detailed guidance on business tax obligations, consult experts from Bestax.

Step 9: Protect Your Business

While business insurance isn’t legally mandatory in Ontario, it’s highly recommended to protect your business from unexpected risks.

Why You Need Business Insurance:

- Protection from liabilities, property damage, or legal claims.

- Helps cover costs associated with unexpected incidents like natural disasters, theft, or lawsuits.

Intellectual Property Protection:

If you have unique ideas, inventions, or brand assets that require protection, explore intellectual property protection through the Canadian Intellectual Property Office (CIPO).

Learn more about trademarks, copyrights, and patents to safeguard your creative assets.

Step 10: Understand the Regulations

Understanding and complying with business regulations in Ontario is crucial for legal and operational success.

Key Areas of Regulation:

- Accessibility for Ontario Businesses: Ensure your business meets accessibility standards.

- Employment Standards: Comply with rules around wages, breaks, and employee rights.

- Workplace Health and Safety: Maintain a safe and healthy environment for employees and customers.

Last Tip: Get Professional Help

Starting a business can feel overwhelming, but you don’t have to do it alone.

At Bestax, we specialize in making the complex simple and stress-free. Our team of experts with 10+ years of experience, will guide you through every step. We handle everything from company registration to tax compliance for setting up your business structure. We ensure that you’re set up for success from day one.

Don’t navigate this journey alone. Let Bestax handle the heavy lifting while you focus on growing your business.

Contact Bestax today and let’s turn your business dreams into reality!

Frequently Asked Questions (FAQs)

What is the easiest business structure for beginners in Ontario?

A sole proprietorship is the easiest and most affordable option for beginners. It offers simplicity and full control but comes with unlimited personal liability.

Do I need to register my business in Ontario?

Yes, if you’re operating under a name other than your legal personal name, you must register with the Ontario Business Registry.

When do I need to register for an HST account?

You must register for a GST/HST account with the Canada Revenue Agency (CRA) if your gross revenue exceeds $30,000 in four consecutive calendar quarters.

Do I need to charge HST in Ontario?

If your business earns $30,000 or more in gross revenue over four consecutive calendar quarters, you must register for a GST/HST account with the CRA. The current HST rate in Ontario is 13%.

Is business insurance mandatory in Ontario?

No, but it’s highly recommended to protect against financial risks, damages, and liabilities.

What’s the difference between a BIN and a BN?

BIN (Business Identification Number): Issued by ServiceOntario after business registration.

BN (Business Number): Issued by the CRA for taxation purposes.

What taxes do I need to pay when running a business in Ontario?

- Sole proprietors and partnerships report income on their personal tax returns.

- Corporations must file a corporate tax return and comply with corporate tax rates.

- You may also need to collect and remit HST (13%) on taxable goods and services.

Do I need a separate bank account for my business?

Yes, having a separate business bank account helps track finances, build business credit, and maintain transparency in your financial records.

What licenses and permits do I need to operate a business in Ontario?

Required licenses and permits depend on your industry, location, and business activities.

How do I set up a home-based business?

- Verify if your local zoning laws allow home-based businesses.

- Register your business name if it’s different from your legal name.

- Obtain any required permits or licenses.

- Dedicate a specific space in your home for business operations.

- Track home office expenses for tax deductions.

How do I incorporate a company in Canada?

- Choose between federal or provincial incorporation.

- Select a unique business name and perform a Nuans Name Search.

- File Articles of Incorporation with the relevant authority.

- Obtain a federal business number (BN) from the CRA.

- Register for corporate tax accounts and apply for necessary permits and licenses.

Disclaimer: The information provided in this blog is for general informational purposes only. For professional assistance and advice, please contact experts.