Have you ever found yourself immersed in spreadsheets, wrestling with VAT calculations and striving to meet compliance demands? If you’re at the helm of a UAE business venture, this scenario probably resonates.

The advent of VAT within the UAE has woven an additional layer into financial management’s fabric; consequently transforming UAE VAT accounting software from a mere convenience to an absolute necessity for business survival. And if you are looking for Bookkeeping Services, BestaxCA will feel honored to be at your service. Now Let’s get into the details of VAT accounting softwares.

Importance of UAE VAT accounting software in UAE

Why is VAT compliant accounting software an absolute necessity in the UAE’s legal landscape? Since its introduction in January 2018, the nation has grappled with a relatively novel VAT framework. Numerous businesses are still coming to terms with these fresh regulations.

UAE VAT accounting software not only simplifies adherence but also results in smooth management of VAT obligations, ensuring legality and precision within this complex system. FTA-approved UAE VAT Accounting software can prove fruitful in the long run, streamlining all the business processes.

Overview of UAE VAT and FTA requirements

After the year 2018, when VAT (Value Added Tax) got introduced in UAE, it seems like a new game for businesses to keep up with.

The Federal Tax Authority (FTA) makes rules and following them means handling VAT calculations, keeping track of expenses, and submitting VAT returns before the deadline. If you miss deadlines or mistakes occur, prepare yourself for a heavy VAT fine! But don’t worry.

Thankfully, there are many software solutions for VAT accounting. These applications can handle various tasks automatically such as calculation of VAT on sales and purchases, monitoring your VAT liability, and even linking with the accounting software you currently use.

Some well-known choices are Zoho Books, Sage Business Cloud Accounting, or Tally. While selecting VAT accounting software, think about features such as user-friendliness, availability on mobile (for keeping track while moving! ), and obviously, FTA approval.

Keep in mind that you want software that simplifies VAT for you and does not be a source of trouble!

Terms you Must Know before using a UAE VAT Accounting Software

Let’s explore the UAE VAT Accounting Software’s terms. These terms are regularly used in the softwares. Knowledge of these terms will help you navigate the softwares easily and streamline your businesses. Here are the main terms that you will come across:

- UAE VAT: This is a value added tax put on many goods and services given within the United Arab Emirates.

- FTA: The FTA, or Federal Tax Authority, is the government organization that looks after UAE VAT. They make and apply all rules and laws businesses need to follow for compliance.

- VAT Compliance: The FTA has specific rules about dealing with VAT. This means that a business needs to fulfill all criteria set by the FTA, such as registering for VAT, calculating VAT precisely, maintaining appropriate records, and submitting VAT returns punctually.

- VAT Returns: These are electronic documents businesses send to the FTA that show what they did with their VAT for one time period. It is very important to file them at the correct time or else there can be penalties.

- VAT Fine: The FTA might charge substantial fines for not following VAT rules, like not submitting VAT returns on time or making wrong calculations in regards to VAT. These can be found in UAE VAT accounting softwares. But wait, If you have been hit with these deadlines BestaxCA could help you with VAT Penality Wavier.

- VAT Calculation: This means deciding the accurate sum of VAT that must be applied on sales and reclaimed from purchases. The task of calculating VAT is done by software for VAT accounting, removing any chances for mistakes to happen.

- VAT Tracking: VAT liability can be complex to manage, but with VAT accounting software you get ongoing visibility on your VAT position. This means you can always check how much VAT you still need to pay or reclaim back in real-time.

- VAT Integration: For businesses using Point-of-Sale (POS) systems, VAT integration enables the UAE VAT accounting software to smoothly link with the VAT POS. This guarantees that VAT is automatically added to transactions, saving you time and reducing the need for manual adjustments.

Know these important terms and use VAT accounting software to make your UAE VAT compliance process easier. This will help you save time, money, and worries.

Keep in mind that choosing FTA-approved software that is easy to use with features like mobile access and strong VAT tracking functions can greatly improve your experience of handling VAT matters.

Top Software Picks for User-Friendly VAT Management

With appropriate UAE VAT accounting software, managing VAT compliance is very easy. Let’s go through some typical inquiries and mention some of the best selections for user-friendly, VAT approved software:

| Feature | Zoho Books | Xero | QuickBooks (UAE Version) |

| Best For | Small & Medium Businesses | Small & Medium Businesses | Businesses of All Sizes |

| Ease of Use | Excellent – Intuitive interface, perfect for beginners. | Excellent – Clean interface, easy to learn. | Good – Well-designed interface, learning resources available. |

| VAT Features |

|

|

|

| Pricing | Free trial for 14 days, starts from 10$ per month | Starts with 29$ per month | Stars with 14$ with free trial |

| Cloud-based | Yes | Yes | Yes |

Simplifying VAT Compliance:

Accounting software that follows VAT rules helps in making VAT calculations, handles your VAT responsibility, and produces reports that align with the UAE’s Federal Tax Authority (FTA).

QuickBooks UAE VAT compliant? Yes, QuickBooks made for the UAE is built to follow VAT rules.

From the options available, there are many choices (like Peachtree accounting software – though it might not be easy to find in the UAE), but here are three well-known picks because of their ease of use and strong VAT functions:

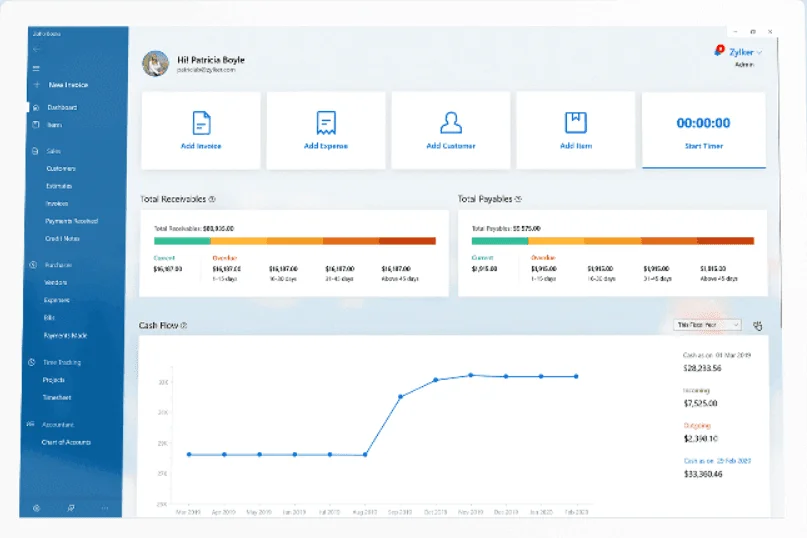

Zoho Books: This software that works in the cloud is a favorite for small and medium businesses. It has an easy interface, simple design which makes it ideal for new users. Zoho Books gives you features like :

- Automated VAT calculations for accuracy.

- Real-time VAT tracking to stay on top of your liability.

- Generation of FTA-compliant VAT reports.

- Mobile app for on-the-go access.

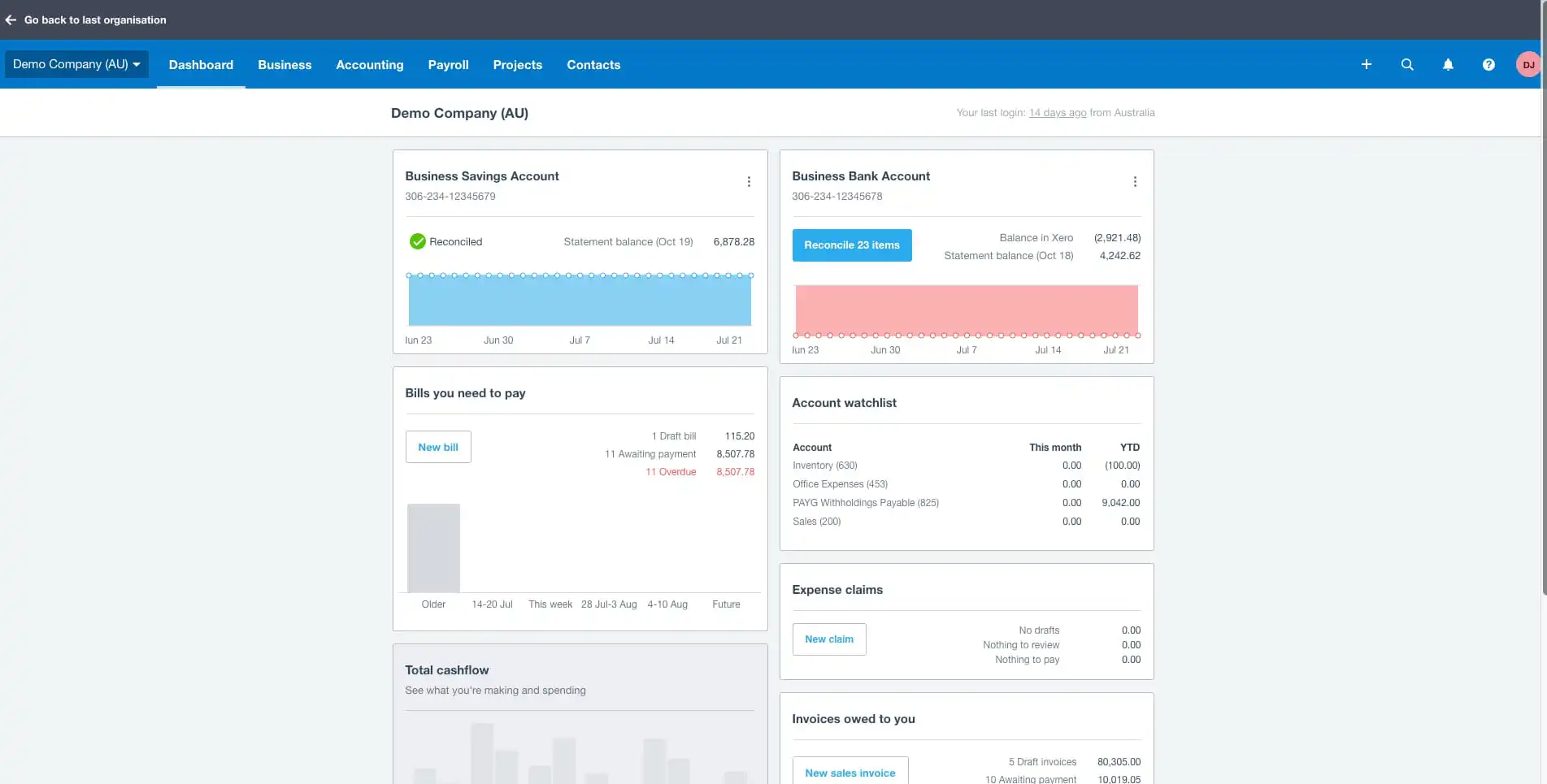

Xero: A different cloud choice that is easy for users, Xero gives importance to clean interface and simple use. Like Zoho Books:

- Automatic VAT calculations.

- VAT tracking functionalities.

- Ability to generate FTA-compliant VAT reports.

- Strong collaboration features to share reports with your accountant.

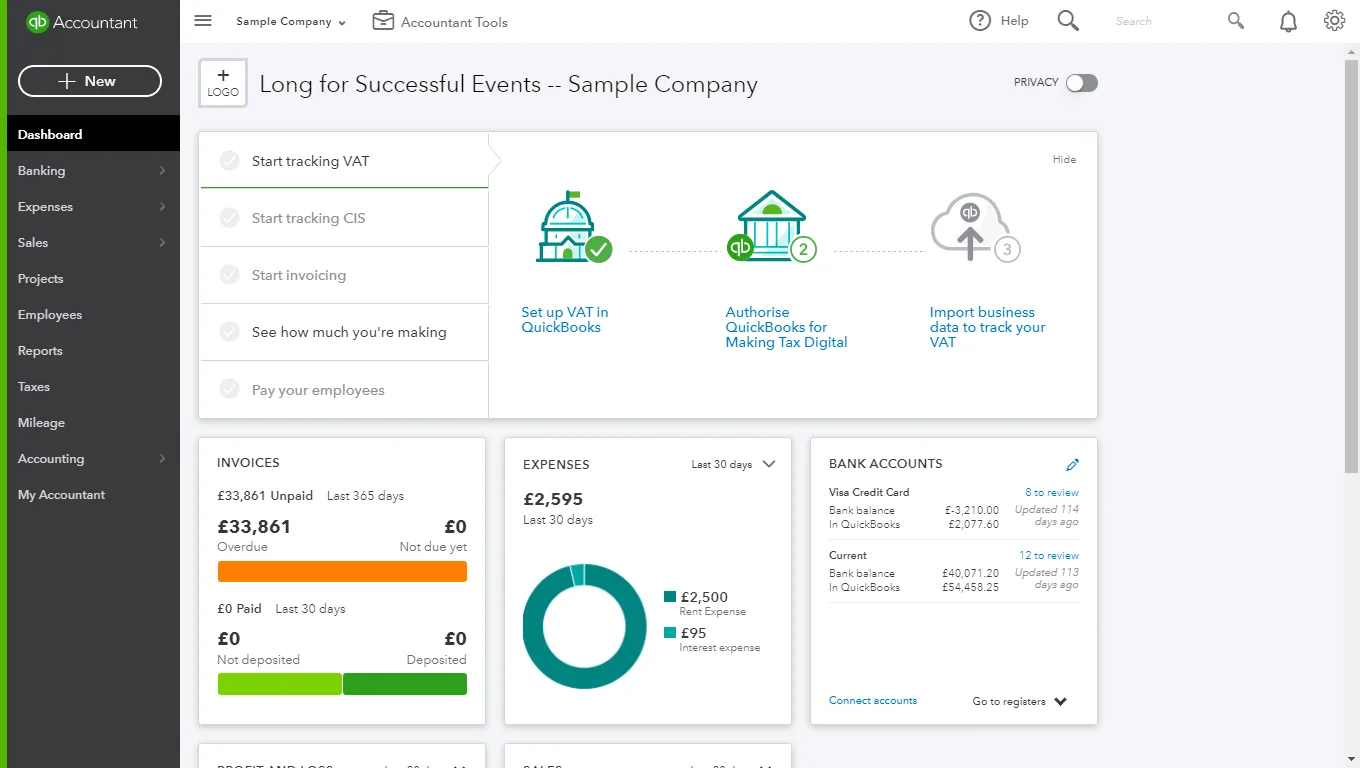

QuickBooks: QuickBooks, a well-known name with businesses, has an interface that is easy to use and provides tutorials as well as support resources. The UAE version deals with:

- VAT calculations.

- Generation of VAT reports.

- Integration with Point-of-Sale (POS) systems.

Finding the Perfect Fit

The software considered as the “best” is different for everyone, based on business size, industry and what features they want. You can look at demos or use free trials from these options that are easy to use and find your VAT champion. Keep in mind that getting the correct UAE VAT compliant accounting software in UAE can make it easier and less stressful to handle VAT compliance!

Essential Features and Attributes of UAE VAT Accounting Software

VAT (Value Added Tax) in the UAE might seem like a puzzling labyrinth.However, your VAT accounting software is here to assist you. Now, we will explore the key characteristics your “VAT software” should have to ensure smooth UAE VAT compliance:

- FTA Approved: This is your golden ticket! Make sure that there is the Federal Tax Authority’s (FTA) stamp on your software. This will guarantee it is in line with all the current UAE VAT rules, making you feel secure. Quickbooks is UAE VAT Accounting Software and it calculates everything with complete accuracy.

- Price: Now, in truth, budgets are significant. this UAE VAT accounting software is available at different prices. So you should think about what your business needs and look for options that give good value for the money spent on them.

Find choices with characteristics which directly benefit how your operations work best to make selection based on these considerations. Check the table above to see the pricing etc. for the softwares.

- Mobile Friendly: The world of business doesn’t end when you step out of the office. Pick a software that has an easy-to-use mobile application, enabling you to view VAT reports, monitor costs or even give your approval for invoices while on the move. Convenience is very important! Zoho books CRM mobile app helps you navigate all your processes on your mobile.

- Cloud-Based: Goodbye to those big servers! With cloud-based VAT accounting software, your data is kept safe on the internet. You can get it from any tool that has connection with the internet. This keeps your VAT information always ready for you and provides recovery if something unexpected happens.

- Customization: Not all businesses are the same. Select software that can be customized in areas like reports, dashboards and workflows for matching your particular VAT necessities.

- Ease of Use: It’s true, dealing with complicated software can be irritating. Choose a software that has an interface which is friendly to users and easy to understand, especially for people who are not very knowledgeable about technology.

- Business Records Management: To ensure VAT compliance, it’s essential to keep track of receipts and invoices. Select software that provides strong business records management functions, so you can store and arrange your financial records effortlessly. This will save you time and annoyance.

- VAT Tracking Capabilities: Handling your VAT liability might seem like a juggling act. Choose a software that has excellent VAT tracking features. This lets you keep an eye on your VAT situation constantly, assuring that you are aware of the precise amount due in VAT or can be refunded to you.

- VAT Calculation Accuracy: Humans can make errors, but not your VAT Software! Pick a software that has precise accuracy in VAT calculation. This guarantees you charge and claim the correct value of VAT every time, keeping away from possible fines by FTA.

Now, by giving importance to these characteristics, your UAE VAT accounting software will be transformed from a weight into an asset. Keep in mind that the correct software can help you save time, money and lots of stress when it comes to dealing with UAE VAT. So, proceed and win over!

Conclusion

To sum up, VAT accounting software is not only beneficial but also crucial for dealing with the intricacies of UAE VAT. It helps in automating calculations, guarantees precision using FTA-approved software, and gives real-time tracking features. This makes managing your taxes an easy task. Therefore, make a proper investment in good VAT accounting software and liberate yourself to concentrate on vital business matters that bring about success.

Your story is valuable! What difficulties have you encountered in relation to VAT, and how has the UAE VAT accounting software assisted? Please let us know your stories in the comment section. Let us all join hands to succeed with UAE VAT! Like, share and subscribe for more updates that are coming your way!