Online accounting software, also known as cloud accounting for UAE businesses, lets you manage your finances from any device. You don’t need to install anything. Just log in through your browser. Everything is saved safely online. This includes your settings, personal data, and your business records.

This kind of software is great for businesses in the UAE. Whether you’re at the office or working from home, your records stay updated and easy to access.

How to Choose the Right Accounting Software for Your Business in the UAE

Let’s go over the key things to look for when choosing the best business financial software in UAE.

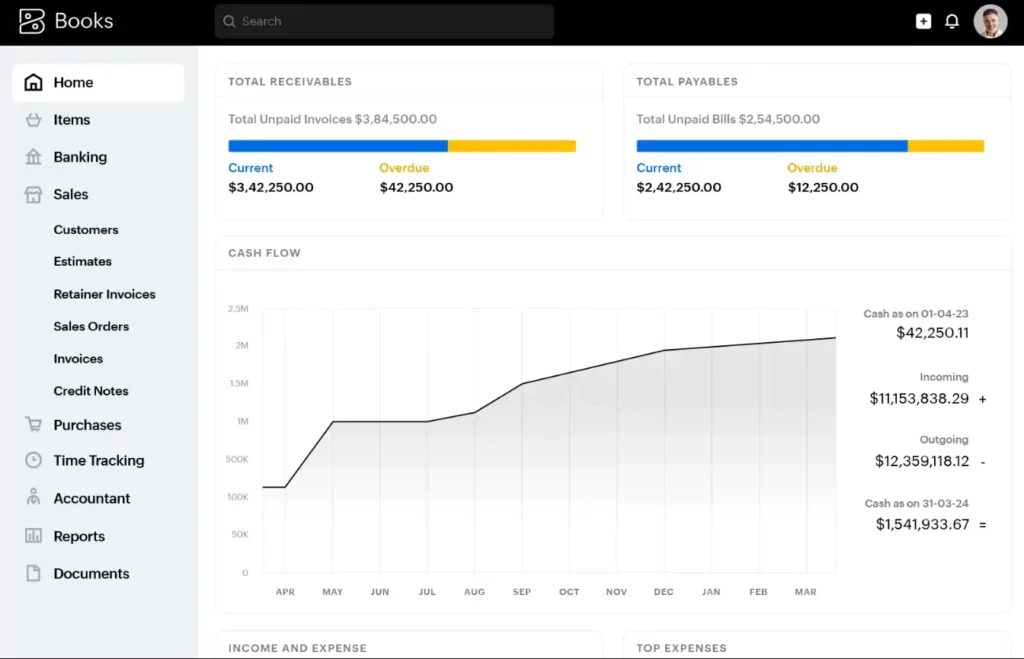

Accounts Receivable and Payable

Your accounting software should track money coming in and going out. This includes what customers owe you and what you owe your vendors. Good company financial management software helps you create invoices, send reminders, and collect online payments.

You should also be able to check unpaid bills and keep track of upcoming payments to your suppliers. This helps you stay organized and avoid missed deadlines.

Cash vs. Accrual Accounting

Small businesses often use the cash method, where you record money when it moves. Bigger businesses that deal with credit might use the accrual method, which tracks income and expenses when they’re earned or owed.

The right bookkeeping software should support both. It should also make switching between methods easy if your business grows.

Payment Gateway Integration

Cloud accounting for UAE businesses should offer payment gateway integration. This makes it easy for customers to pay you online through credit cards, debit cards, or bank transfers.

Project and Time Tracking

If your business runs on projects, you’ll need tools to track time and project billing. The software should let you charge clients by the hour or set a fixed cost.

It should also track time spent on each task and let you turn those hours into invoices. Look for approval features, too. These help you avoid mistakes in billing.

Bank Reconciliation

A reliable automated accounting software in the UAE will connect with your bank and get all statements for you. It should also let you set rules to match and sort your transactions. This makes reconciling easier and helps you stay ready for audits.

VAT and Tax Compliance

Your accounting system should calculate VAT, support different tax rates, and generate the right reports. This will help you follow UAE tax rules. Look for UAE VAT accounting software that simplifies this process and keeps your business compliant.

Automation Features

The more you can automate, the better. Look for software that sends out automatic payment reminders, handles recurring bills, and even charges credit cards on schedule.

Some UAE tax compliance software also lets you scan receipts and turn them into transactions. This saves you time and cuts down on manual work.

Integration with Other Tools

It should connect with tools like CRM systems, inventory apps, or project management software. This means you won’t need to enter the same data in different places. Updates in one app will reflect in the other, keeping everything in sync.

Reporting and Insights

Choose software that gives you clear reports. You should be able to see your balance sheet, income, and cash flow at a glance.

Reports should also cover areas like receivables, payables, tax, and projects. This helps you see what’s working and where you can improve.

Usability Features to Look for in Accounting Software

A system that looks good and works smoothly will make your daily tasks faster and less stressful. Here are a few key usability features that matter when picking business accounting tools in the UAE.

Simple Interface That’s Easy to Use

The software you choose should make accounting feel less complicated. Look for a clean design that helps you focus on what matters.

It should be easy to navigate and let you finish tasks without confusion. This helps save time and reduces mistakes, especially if more than one person is handling the accounts.

Strong Data Security

A trusted accounting software has security features like encryption and two-factor authentication. These features protect your business from unwanted access.

Mobile Access for Flexibility

A practical accounting software lets you check reports, send invoices, and track expenses from your phone or tablet. Whether you’re at a client meeting or traveling, you can still manage your finances on the go.

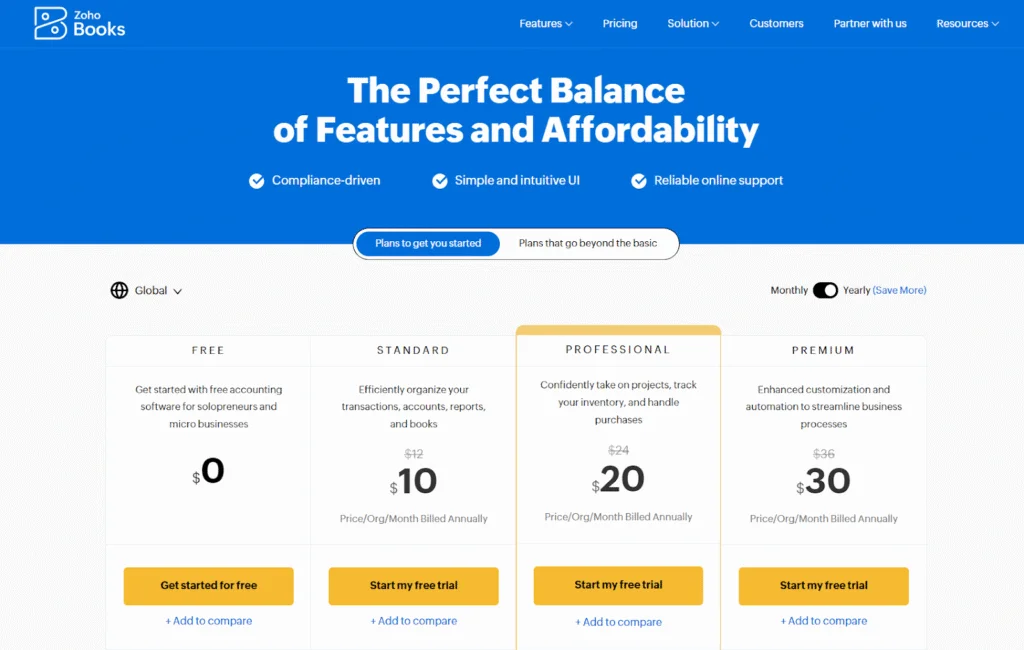

Clear Pricing with No Surprises

Choose one that fits your budget and needs. Make sure the pricing includes things like support, updates, and access for multiple users. You don’t want extra charges showing up later for features you expected to be included.

In short, ease of use is just as important as the features. Look for software that is easy to usel, protects your data, works anywhere, and grows with your team.

Top Accounting Software for UAE Businesses

The top three popular and trusted options are Zoho Books, QuickBooks, and Xero. Each offers strong features for financial management, cloud access, and VAT compliance.

Zoho Books – Flexible, Reliable, and FTA-Approved

Zoho Books is known for being simple and easy to use. It connects with popular apps like Google Drive and Dropbox for smooth cloud accounting for UAE businesses. You can also use it on Android, iPhone, or even Windows phones, great for business owners who are always on the move.

What makes it stand out is its strong UAE VAT accounting software features. It’s one of the few tools officially approved by the Federal Tax Authority (FTA) in the UAE, making it a reliable choice for UAE tax compliance software.

Key Features of Zoho Books

1. Receivables & Invoicing

- Create and send professional, branded invoices.

- Generate quotes and convert them into invoices seamlessly.

- Set up recurring invoices and automate payment reminders.

- Accept online payments through integrated payment gateways.

2. Payables & Expense Management

- Record and manage vendor bills and expenses.

- Track outstanding payments and apply vendor credits.

- Auto-scan expense receipts and categorize them for better insights.

- Set up purchase orders and manage the approval process.

3. Banking & Reconciliation

- Connect bank accounts to fetch transactions automatically.

- Categorize and match transactions using intelligent algorithms.

- Reconcile accounts efficiently to ensure accurate financial records.

4. Inventory Management

- Track inventory levels, set reorder points, and manage stock.

- Create price lists and manage item details, including SKUs and product images.

- Handle inventory adjustments and integrate with eCommerce platforms like Amazon, Etsy, and Shopify.

5. Project Accounting

- Manage multiple projects with task assignments and time tracking.

- Set project budgets and monitor profitability.

- Invoice clients based on time spent or fixed project costs.

6. Tax Compliance

- Track sales tax, manage tax exemptions, and generate tax reports.

- Handle 1099 forms and W-9 management with ease.

- Simplify tax filing with integrations for e-filing and compliance.

7. Reporting & Analytics

- Access over 70 built-in reports covering various aspects of your business.

- Customize reports with filters, date ranges, and reporting tags.

- Share reports securely with stakeholders and schedule periodic emails.

8. Collaboration & User Management

- Invite team members, accountants, and clients to collaborate within Zoho Books.

- Set user roles and permissions to control access to data.

- Utilize customer and vendor portals for real-time communication and document sharing.

9. Automation & Customization

- Automate recurring transactions, payment reminders, and workflows.

- Customize templates, fields, and reports to match your business needs.

- Integrate with other Zoho apps and third-party applications for extended functionality.

10. Global Operations

- Handle multi-currency transactions with automatic exchange rate calculations.

- Operate in multiple languages to cater to a diverse client base.

- Ensure compliance with international standards like GDPR and HIPAA

QuickBooks – Familiar and Trusted Worldwide

QuickBooks is a popular name in business accounting tools, and for good reason. It’s used by accounting firms around the world, including many in the UAE. That makes it easier to share your data with your accountant.

Key Features of QuickBooks Online

1. Invoicing & Payments

- Create and send professional, customized invoices.

- Set up recurring invoices and automate payment reminders.

- Accept online payments through integrated payment gateways.

2. Expense Tracking & Receipt Management

- Record and categorize expenses effortlessly.

- Capture and organize receipts using the mobile app.

- Match receipts to corresponding expenses for accurate record-keeping.

3. Banking & Reconciliation

- Connect your bank accounts to automatically import transactions.

- Reconcile accounts to ensure accurate financial records.

4. Inventory Management

- Track inventory levels in real-time.

- Manage stock across multiple locations.

- Receive alerts when inventory is low.

5. Multi-Currency Support

- Handle transactions in over 145 international currencies.

- Assign specific currencies to customers, suppliers, and accounts.

- Automatically adjust for exchange rate fluctuations.

6. Tax Compliance

- Track and manage GST, VAT, and sales tax.

- Generate tax reports to simplify filing processes.

7. Reporting & Analytics

- Access a variety of built-in reports to monitor business performance.

- Customize reports with filters and tags for deeper insights.

- Utilize the cash flow planner to forecast future financial positions.

8. Mobile App

- Manage your business on-the-go with the QuickBooks mobile app.

- Send invoices, capture receipts, and track expenses from your mobile device.

9. User Access & Collaboration

- Invite your accountant, bookkeeper, or team members to collaborate.

- Set user roles and permissions to control access to sensitive data.

10. Integration & Customization

- Integrate with a wide range of third-party apps to extend functionality.

- Customize fields, templates, and reports to fit your business needs.

Xero – Modern, App-Friendly, and Cloud-Based

Xero brings accounting into the modern age. It’s a fully cloud-based system that helps you work smarter and faster. One standout feature is the Xero App Store, which lets you connect hundreds of apps for things like sales, CRM, HR, inventory, and e-commerce. This helps turn traditional bookkeeping into a fully automated accounting software UAE system.

Key Features of Xero

1. Invoicing & Payments

- Create and send professional invoices with customizable templates.

- Automate invoice reminders to encourage timely payments.

- Accept payments via credit card, debit card, or direct debit to improve cash flow.

2. Banking & Reconciliation

- Connect to over 21,000 financial institutions worldwide for automatic bank feeds.

- Reconcile transactions quickly with smart matching and suggestions.

3. Expense Management

- Track and manage business expenses efficiently.

- Submit and approve expense claims with ease.

- Capture receipts and bills using Hubdoc for automatic data extraction.

4. Inventory Management

- Monitor stock levels in real-time and manage up to 4,000 finished items.

- Add inventory items directly to invoices and purchase orders.

- Gain insights into top-selling products to inform purchasing decisions.

5. Project Tracking

- Plan, budget, and track projects with job costing tools.

- Record time and expenses against specific projects.

- Invoice clients based on project progress or time spent.

6. Payroll Integration

- Integrate with Gusto for full-service payroll processing.

- Automate employee pay calculations and tax filings.

- Ensure compliance with local payroll regulations.

7. Reporting & Analytics

- Access a variety of financial reports, including profit and loss, balance sheet, and cash flow statements.

- Upgrade to Analytics Plus for advanced forecasting and customizable dashboards.

8. Multi-Currency Support

- Handle transactions in over 160 currencies with automatic exchange rate updates.

- Simplify international business operations and reporting.

9. Mobile Accessibility

- Manage your business finances on the go with the Xero mobile app.

- Create invoices, capture receipts, and reconcile transactions from your smartphone or tablet.

10. App Integrations

- Connect with over 1,000 third-party apps through the Xero App Store.

- Enhance functionality with integrations for CRM, eCommerce, time tracking, and more.

Make Accounting Simple with Bestax

Choosing the right accounting software, like Zoho Books, QuickBooks, or Xero, can help you manage your business smartly and stay VAT-compliant. But the real value comes with the right support.

Bestax is a Zoho Authorised Partner offering complete end-to-end accounting software services. We make accounting software easy with:

- Business needs assessment

- Full setup and implementation

- Staff training and ongoing support

- Seamless integration with tools like CRM and HR systems

With Bestax, you don’t just get software, you get a reliable team to help you every step of the way. Let us help you make the switch to smart, cloud-based accounting in the UAE.

Quick FAQs

Which accounting software works best for small businesses in the UAE?

Zoho Books and Xero are great options. They’re affordable, VAT-compliant, and built for ease of use.

What are the features to look for in accounting software for UAE companies?

Look for VAT tracking, invoicing, bank integration, and cloud access. Easy setup and mobile access are also important.

Can I use cloud accounting software for my UAE business?

Yes, cloud accounting is ideal for UAE businesses. It lets you access your accounts anytime and keeps your data secure.

How do I find the right accounting software for my company in the UAE?

Consult with a local expert like Bestax. We assess your needs and guide you toward the best software for your business.

What’s the most affordable accounting software for UAE businesses?

Zoho Books is a budget-friendly choice with strong features. It’s also approved by the UAE’s Federal Tax Authority.

Disclaimer: The information provided in this blog is for general informational purposes only. For professional assistance and advice, please contact experts.