For nearly two decades, Bestax Chartered Accountants has been at the forefront of financial consultancy in Dubai.We have been helping businesses of all sizes with VAT, corporate tax, excise tax, and other financial obligations with 100% accuracy.

Now, as an FTA-Approved Tax Agency in Dubai, Bestax reaffirms its commitment to guiding businesses through tax regulations, safeguarding their compliance, and driving sustainable financial growth.

An FTA-Approved Tax Agency isn’t just a consultant, it’s your official bridge to the Federal Tax Authority (FTA). These certified experts ensure your business meets every tax obligation, avoids costly mistakes, and operates smoothly in compliance with UAE laws.But what exactly does an FTA-Approved Tax Agent do, and why is their role so crucial? Let’s break it down

Why You Need an FTA-Approved Tax Agent

UAE’s tax system is straight up complex. It can make anyone overwhelmed. With multiple regulations, strict deadlines, and compliance requirements, managing tax requires both expertise and precision.

This is where an FTA-Approved Tax Agent becomes not just helpful but essential. According to Federal Law No. (7) of 2017 on Tax Procedures, a Tax Agent is defined as:

“Any Person registered with the Authority in the Register, who is appointed on behalf of another person to represent him before the Authority and assist him in the fulfillment of his Tax obligations and the exercise of his associated tax rights.”

The Federal Law No. (7) of 2017 on Tax Procedures laid out how taxes in the country are implemented, managed, and enforced. This law also introduced the critical role of Tax Agents, professionals who represent businesses before the FTA. The Federal Tax Authority (FTA) also maintains a public register of approved tax agents to make it easy for you to select a tax agent.

There is more than one reason to select a FTA approved agent in Dubai and they are as follows:

1. Expert Knowledge and Compliance Assurance

Tax laws in the UAE, including VAT (Value Added Tax) and Corporate Tax, are constantly evolving. An FTA-Approved Tax Agent is well-versed in these regulations, ensuring that your business adheres to all requirements. Compliance mistakes can lead to severe penalties, making professional expertise essential.

2. Representation Before the Federal Tax Authority (FTA)

In the event of audits, disputes, or clarifications, an FTA-Approved Tax Agent serves as an official representative of your business before the FTA. This representation ensures that your case is presented accurately and professionally, reducing the likelihood of unfavorable outcomes.

3. Accuracy in Filing and Reporting

Tax agents ensure that tax returns, financial reports, and documentation are prepared and filed accurately, avoiding costly mistakes and misinterpretations of tax laws.

4. Time and Resource Efficiency

Managing tax compliance in-house requires dedicated personnel, resources, and time. By outsourcing to an FTA-Approved Tax Agent, your business can focus on core operations while leaving the complexities of taxation to professionals.

5. Risk Management and Penalty Avoidance

Tax agents proactively identify potential compliance risks and implement strategies to address them, minimizing exposure to penalties or legal issues.

6. Confidentiality and Integrity

Tax agents are bound by strict confidentiality agreements, ensuring your financial information remains secure and private.

In short, an FTA-Approved Tax Agent acts as a bridge between your business and the Federal Tax Authority, safeguarding your financial interests while maintaining full compliance with UAE laws.

Duties of an FTA-Approved Tax Agent

Under UAE tax laws, FTA-Approved Tax Agents have specific duties and responsibilities that they must adhere to. These duties ensure a high standard of professionalism, confidentiality, and legal compliance in their practice.

1. Assisting the Taxable Person with Tax Obligations

- An FTA-Approved Tax Agent is obligated to assist taxable persons (businesses or individuals) in fulfilling their tax responsibilities.

- This assistance is governed by a contractual agreement between the taxable person and the tax agent.

- Every task must align with the tax agent’s duties as outlined in UAE tax legislation.

Key Responsibilities Include:

- Accurate preparation and submission of tax returns.

- Ensuring VAT and corporate tax filings comply with FTA regulations.

- Advising on proper tax strategies to optimize financial outcomes.

2. Maintaining Confidentiality of Information

- An FTA-Approved Tax Agent must maintain complete confidentiality regarding any information obtained while performing their duties.

- This duty extends beyond the duration of their contract and remains in effect even after professional relationships are terminated.

Key Responsibilities Include:

- Protecting sensitive financial information from unauthorized access or disclosure.

- Ensuring secure handling and storage of client documentation.

- Upholding professional ethics at all times.

3. Refusal to Engage in Illegal or Unethical Practices

- Tax agents must refuse to participate in any activity or scheme that could violate UAE tax laws or jeopardize the integrity of the tax system.

- Ethical responsibility is paramount, and agents must act with integrity in every professional engagement.

Key Responsibilities Include:

- Avoiding participation in fraudulent tax practices.

- Reporting any suspicious or unethical activities to the relevant authorities if required.

- Ensuring complete transparency in all tax dealings.

Prohibited Practice: Unauthorized Tax Agent Services

In the UAE, it is strictly prohibited to practice as a Tax Agent without completing registration and receiving accreditation from the Federal Tax Authority (FTA). Doing so constitutes a legal offense and can result in:

- Severe Penalties: Financial fines and legal consequences.

- Loss of Business Credibility: Businesses associating with unregistered agents may also face penalties.

- Legal Action: Unauthorized tax practices are viewed as criminal offenses under UAE law.

Why Accreditation Matters

- Accreditation ensures the agent meets the strict standards set by the FTA.

- Only accredited agents can officially represent businesses before the FTA.

- It protects businesses from being misled or misrepresented by unauthorized agents.

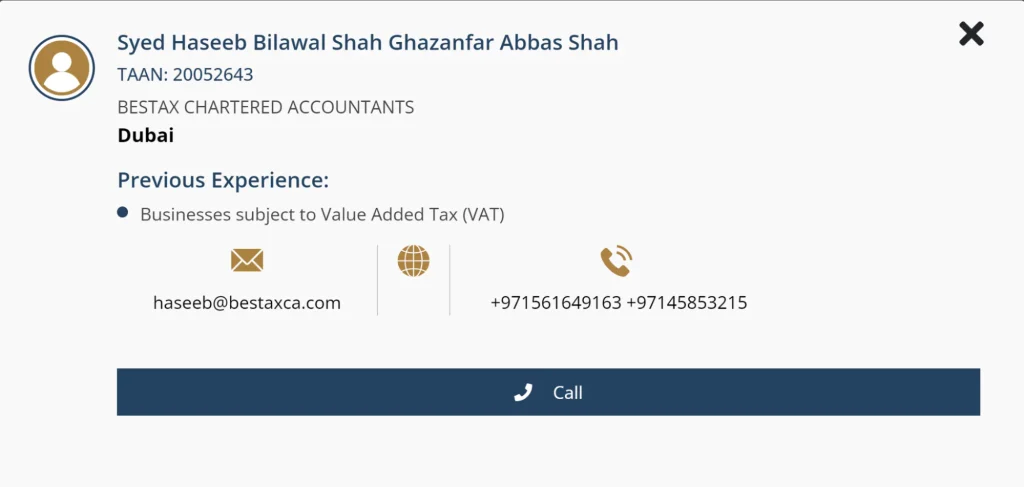

Who is Bestax Chartered Accountants?

Bestax Chartered Accountants is a leading tax consultancy firm offering specialized services in VAT, corporate tax, company formation, accounting services, excise tax, financial advisory, and many more. With an emphasis on accuracy, transparency, and tailored solutions, we’ve become a trusted name in the UAE business community.

As an FTA-approved tax Agency, we are authorized to assist businesses in fulfilling their obligations under UAE tax laws, ensuring seamless compliance and optimized financial performance.

Core Values at Bestax Chartered Accountants:

- Integrity: Upholding transparency and trust in every client interaction.

- Expertise: A team of certified professionals with years of experience in UAE taxation.

- Client-Centric Approach: Personalized solutions tailored to each business’s unique needs

Benefits of Working with an FTA-Approved Tax Agency Like Bestax

Partnering with an FTA-Approved Tax Agency comes with numerous advantages. Here’s how Bestax helps businesses succeed in their tax journey:

1. Enhanced Compliance and Risk Management

We ensure your filings are accurate, timely, and compliant with all federal tax regulations, eliminating the risk of costly penalties.

2. Expert Representation Before Authorities

As an FTA-Approved Tax Agency, we represent your business confidently during audits or tax assessments, providing reliable and knowledgeable advocacy.

3. Tailored Tax Strategies

Every business is unique, and so are its tax needs. We craft personalized strategies to minimize liabilities and maximize savings.

4. Proactive Tax Planning

Tax regulations are dynamic. As an FTA-Approved Tax Agency, we stay ahead of legislative updates to ensure your business remains compliant at all times.

5. Time and Cost Efficiency

By outsourcing your tax functions to an FTA-Approved Tax Agency, your team can focus on core business operations while we handle compliance efficiently.

Why Bestax Chartered Accountants Stands Out as an FTA-Approved Tax Agency

In a competitive market, choosing the right FTA-Approved Tax Agency can make a significant difference in your business’s financial health and compliance status. Here’s why Bestax stands out:

- Proven Track Record: With over 19+ experience of successful representation in complex audits and dispute resolutions.

- Certified Professionals: Our team comprises experts trained and certified under FTA regulations.

- Client-Centric Services: Solutions tailored to your business requirements.

- Proactive Approach: Regular updates and continuous support on changing tax laws.

Here’s what one of our valued clients has to say about their experience with us:

Altanat Kairzhanova – ⭐️⭐️⭐️⭐️⭐️

“I had a very good experience with Bestax. All my clients who registered for Corporate Tax and subscribed to their accounting services are more than happy. A very friendly team of professionals supports their clients at the highest level.”

At Bestax, client satisfaction isn’t just a goal—it’s our standard. Your success is our successsucces.

Take the Next Step Towards Stress-Free Tax Compliance

At Bestax Chartered Accountants, we don’t just offer tax services, we deliver peace of mind. With over 19 years of experience and our status as an FTA-Approved Tax Agency in Dubai, we are your trusted partner in financial compliance and success.

Get in Touch with Us Today!

Bestax Chartered Accountants – Your Trusted FTA-Approved Tax Agency in Dubai. Simplify Compliance, Secure Success, and Drive Growth!