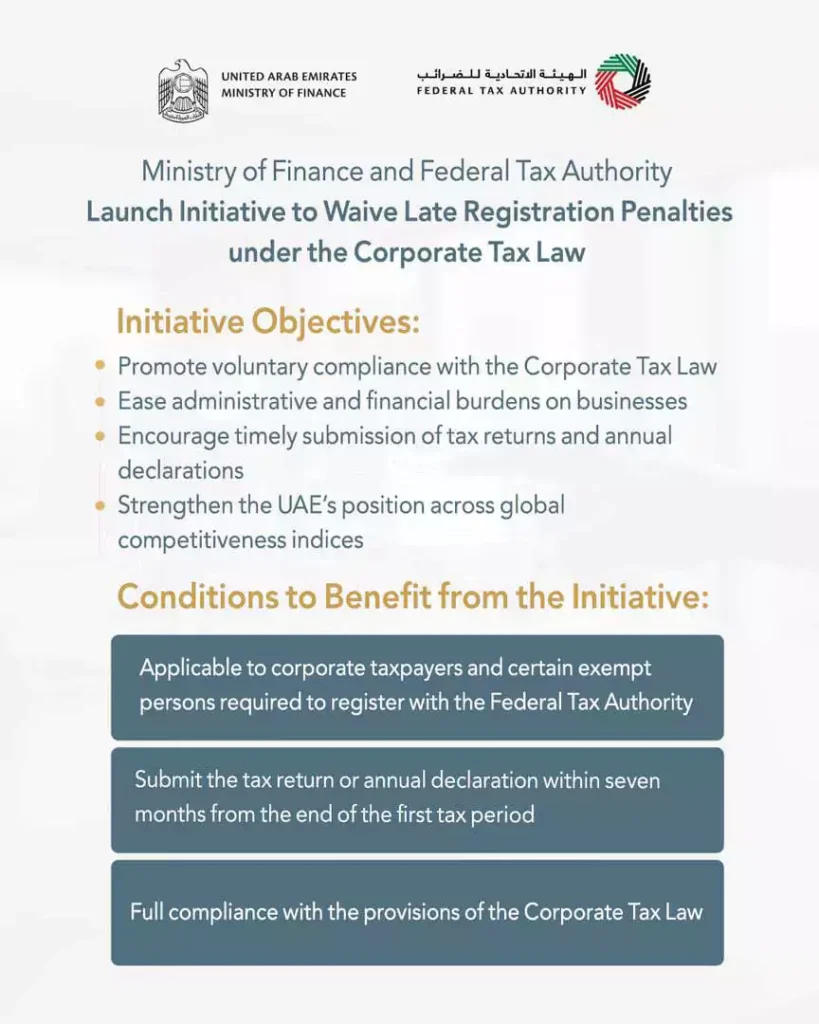

The Ministry of Finance (MoF) and the Federal Tax Authority (FTA) in the UAE have taken a major step to support businesses. They have launched a Cabinet Decision that offers a way to waive administrative penalties. This applies to companies and certain exempt persons who did not register for corporate tax on time.

This move is part of a bigger plan to help businesses adjust to the Corporate Tax Law. Many companies are still getting used to the new rules. The waiver gives them extra time to file their tax returns or annual financial statements. To benefit from this, they must file within seven months from the end of their first tax period.

This means if your business had its first tax period end on 31 December 2024, your deadline to file is 31 July 2025. If you submit by that date, you can avoid the AED 10,000 late registration fine. This is a part of the FTA penalty relief initiative.

The goal is to increase tax compliance and encourage early filings. By making it easier for companies to meet their obligations, the MoF and FTA are showing strong support for businesses during this first year of the new tax system.

Why the Corporate Tax Penalty Waiver Matters

The decision is more than just a fine exemption. It shows the government’s support for businesses. This initiative helps lower financial stress, especially for small and medium-sized companies.

Many businesses were unclear about their tax obligations. The FTA and MoF now offer more time and a second chance to promote corporate tax compliance instead of punishment. Companies that take advantage of this will be better prepared for future filings.

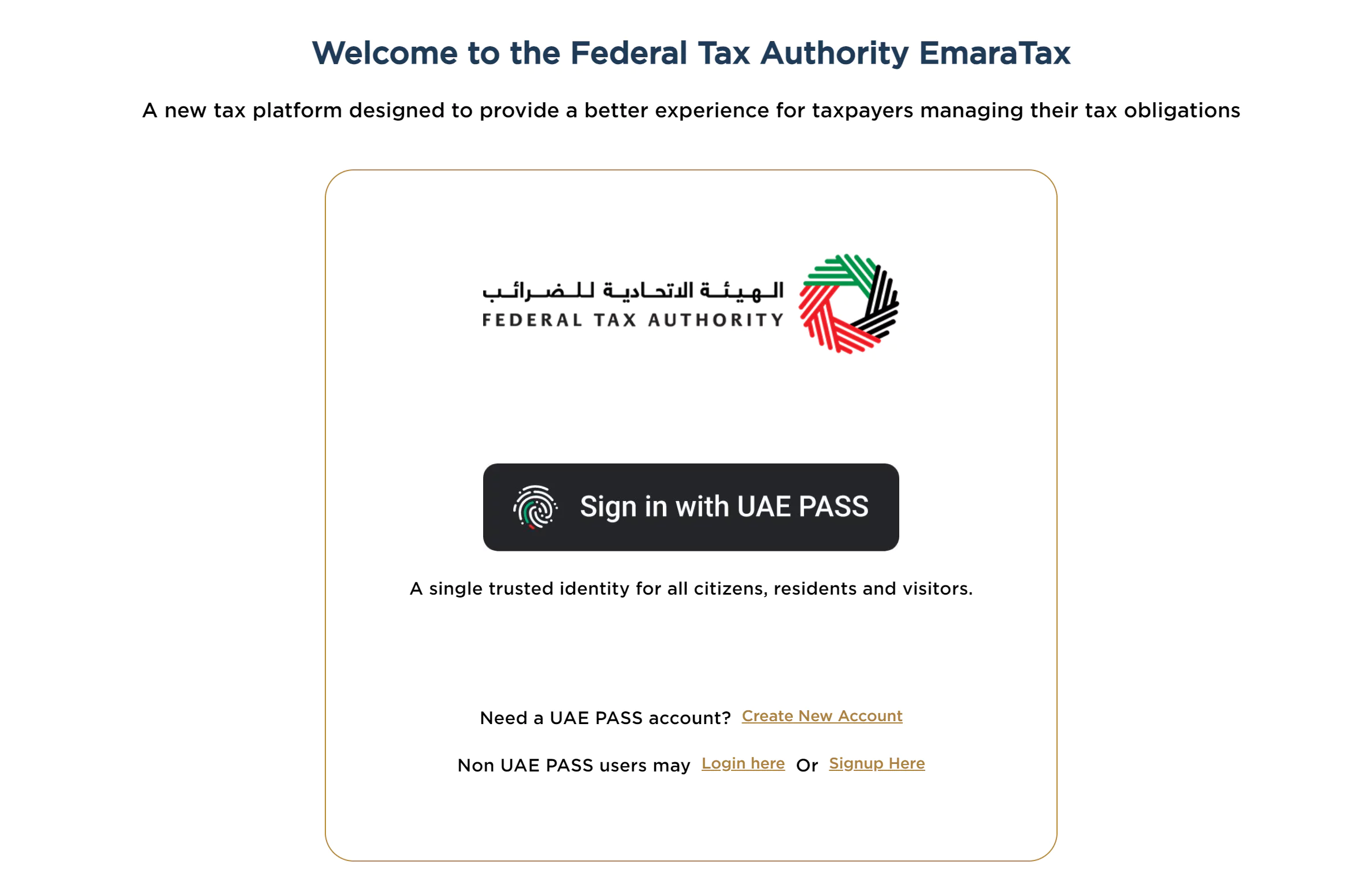

This also sends a message. The UAE is serious about building a modern tax system. But it also wants to help businesses grow, not burden them. The EmaraTax platform is a big part of that. It makes it easier to file, pay, and track taxes.

What is the UAE Corporate Tax Penalty Waiver?

The Corporate Tax Penalty Waiver is a special, one-time offer. It started in April 2025. It gives businesses and exempt entities a chance to avoid penalties. But only if they register and submit their Corporate Tax return or annual statement on time.

The rule is simple. You have seven months to file from the end of your first tax period. If you meet this rule, the FTA will not charge the AED 10,000 fine. If you have already paid it, you can even apply for a refund.

Here’s an example: If your first tax period ended on 31 December 2024, you must file by 31 July 2025 to qualify. Miss that, and the penalty stays.

Who Can Benefit from the Penalty Waiver?

The waiver is open to many types of businesses. You qualify if you are:

- A taxable business (LLCs, private firms, etc.)

- An exempt entity (like public benefit groups or investment funds)

- A Free Zone company earning qualifying income and maintaining adequate substance in the UAE

- A Mainland company with a valid license

- Any taxable business (e.g., LLCs, private firms) or exempt entity, regardless of size or startup status, that is registered for corporate tax

To qualify, you must:

- File your Corporate Tax return within seven months

- Submit correct and complete financial statements

- Keep your bookkeeping and records up to date

The waiver is not available to all businesses. Eligible entities must be registered for corporate tax and file within seven months of their first tax period’s end. Penalties related to tax evasion or deliberate non-compliance are excluded. The FTA verifies compliance, so ensure accurate filings.

Why Was This Introduced?

The MoF and FTA are clear. The waiver is a transition tool. It’s meant to support businesses as they adjust to the new law.

There are several reasons behind this move:

- Help businesses, especially SMEs, deal with new tax rules

- Give companies time to learn how to use EmaraTax

- Boost early and voluntary registration

- Create a culture of tax compliance

- Improve tax transparency and reporting

This also helps the UAE grow its non-oil revenue. It aligns the country with global tax standards and ensures fair practice. The Cabinet’s decision makes it easier for companies to join the system without stress.

Key Deadlines and Tax Periods

Understanding your tax period is key. Your first tax period depends on your company’s license issue date and fiscal year-end. Here are examples:

| Company Incorporation Date | First Tax Period | Filing Deadline (Waiver Eligible) |

|---|---|---|

| Jan 1, 2024 | Jan–Dec 2024 | July 31, 2025 |

| July 1, 2024 | Jul 2024–Jun 2025 | Jan 31, 2026 |

| Nov 1, 2024 | Nov 2024–Oct 2025 | May 31, 2026 |

FTA Requirements to Qualify

To benefit from the waiver, you must follow all FTA rules:

- File the Corporate Tax return correctly

- Submit within 7 months of the tax period end

- Maintain accurate financial records in accordance with International Financial Reporting Standards (IFRS)

- Be ready with documents in case of an audit

Using EmaraTax helps avoid mistakes. It is the official platform for tax filing in the UAE. It also tracks your penalties and refund requests.

How to Use EmaraTax for Tax Compliance

The EmaraTax platform is your tool to stay compliant.

It lets you:

Register for Corporate Tax

Submit tax returns and statements

Apply for penalty refunds

View your filing history

To get started:

Log into EmaraTax.

Check your company details.

Choose your tax period.

Upload financial statements.

Submit your return.

Make sure everything is accurate. Mistakes can lead to delays or fines.

Refund Procedures for Paid Fines

If you already paid the AED 10,000 fine, you might still get it back. The FTA has set up a process for refunds.

To apply:

- Log in to EmaraTax.

- Navigate to the penalties section.

- Submit a refund request.

- Attach proof of timely return submission.

- Wait for FTA review and confirmation.

Keep your documents ready. Refunds take time, but are processed if all conditions are met.

UAE’s Long-Term Tax Goals

This waiver is part of a bigger plan. The UAE wants to become a global hub for business. A fair and easy tax system helps with that.

By offering this penalty waiver, the UAE is:

- Supporting national businesses

- Making tax compliance easier

- Boosting global competitiveness rankings

- Building trust in its tax system

Businesses that take advantage of this now will benefit long-term. Early compliance leads to fewer issues down the line.

Next Steps for Businesses

If you haven’t registered for Corporate Tax, do it now. Check your tax period. Use the seven-month rule. File your returns through EmaraTax. Keep your financials clean and ready.

Don’t miss the deadline. Avoid the AED 10,000 fine. Make use of the FTA penalty relief initiative today.

Need help? Bestax can guide you. But don’t wait. The seven-month deadline for corporate tax compliance is already counting down. Contact us now for corporate return filing services.

Quick FAQs

1. What is the UAE corporate tax penalty waiver, and how does it work?

The UAE corporate tax penalty waiver is a temporary relief initiative by the Federal Tax Authority (FTA). It allows businesses that missed the tax registration deadline to avoid the AED 10,000 late registration fine if they submit their corporate tax return within seven months from the end of their first tax period.

2. Am I eligible for the UAE tax penalty exemption in 2025?

You may qualify if you are a taxable entity or an exempt person and file your corporate tax return on time.

3. How can I file corporate tax returns in the UAE through EmaraTax?

To file, log in to the EmaraTax platform, select your first tax period, upload financials, and submit your return. The system guides you step-by-step.

4. Can I get a refund for corporate tax penalties already paid?

If you have paid the AED 10,000 administrative fine but later qualified for the waiver, you can apply for a refund.

5. What happens if I miss the tax registration deadline in the UAE?

If you miss the deadline and don’t file within the grace period, the FTA will impose an administrative fine of AED 10,000. You will also lose access to the penalty waiver and may face more penalties..

Disclaimer: The information provided in this blog is for general informational purposes only. For professional assistance and advice, please contact experts.